Kerikeri prices continue to fall, inventory levels are rising, sales volumes are at record lows but serious buyers are starting to return as they sell in other areas.

Kerikeri Market Update

Following the trends of other markets around New Zealand, sales volumes are low and median prices are now dropping in Kerikeri after showing resilience through the first 3 quarters of 2022. The number of properties for sale is rising and there is over a year’s worth of inventory at current sales levels. The affects of cheap money being pumped into the economy during the pandemic pushing property prices up, creating a price bubble, are now being corrected across New Zealand.

Weather events impeding travel are partly to blame for lower sales volumes but we are seeing buyers who have sold in other places in position to make cash offers. Most economists are predicting property prices to stabilize in 2023 as interest rates flatten out, net migration turns from “brain drain” to “brain gain”, and buyers take advantage of the wider choice of properties for sale and lower prices.

What’s happening with house prices?

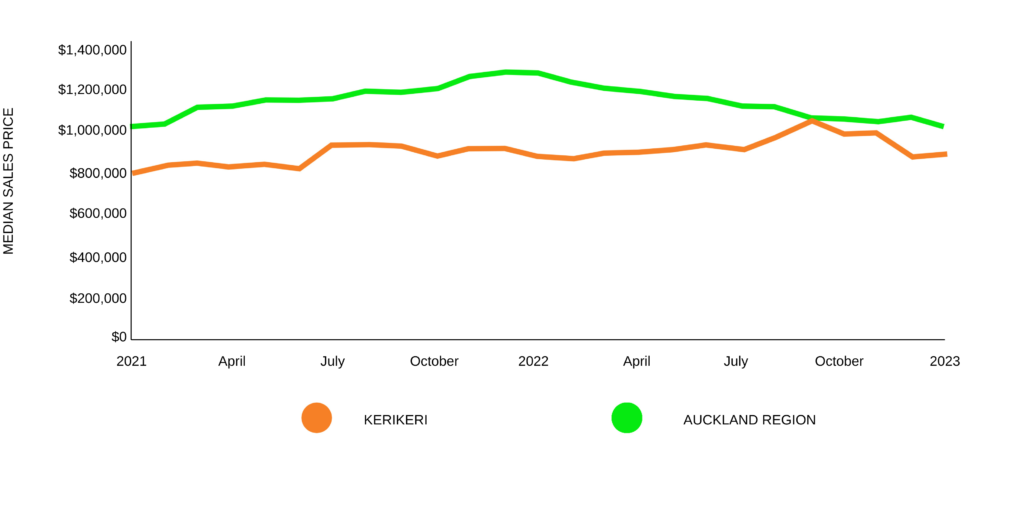

The quarterly median price for a house in Kerikeri for sales completed during the 3 month period of November, December and January was $885,000. That is up 1.1% from the same period 1 year ago and up 22.9% from 3 years ago. It is down 15% from the peak period reached in 3rd quarter 2022 and thus it appears that most price gains made in 2022 are now being reversed. (I should caution that low volumes of sales make inferences on median price comparisons less reliable, particularly on a “month to month” basis which is the reason I use quarter to quarter comparisons. However even a change in the mix of properties sold within one quarter to another can make comparisons difficult. Unfortunately, REINZ does not provide a house price index comparison, which adjusts for these variations, below the regional level, so we have to use the raw data we have to try to draw comparisons.)

By comparison Auckland and Wellington regions are down 20.3% and 19.3 % respectively from their peak values reached in 4th quarter 2021 (9 months prior to Kerikeri’s peak) and have effectively wiped out any median price gains since January 2021.

At this point in time, the regions outside the major centres have not seen the size of price corrections that Auckland and Wellington have but nor did they experience the size of price increases during the Covid-19 driven bubble. The next 12 months will illuminate whether our prices continue to decline as a lagging trend behind the major centres or whether we hit bottom sooner.

What are the market drivers?

The effects of higher and rising interest rates, slower sales in Auckland and Wellington affecting the ability of city buyers to move to the Far North and general uncertainty on market conditions and the economy, have caused a dramatic slowdown in enquiries and sales. This has led to increased inventory of properties for sale across Kerikeri and the district.

The positive news is that there is still a steady stream of people wishing to move north for lifestyle change driven by reflection of what is important to them during the Covid-19 lockdowns. As soon as they sell, they are looking to travel up and find their new home so they can retire or work where they want to live. Auckland sales volumes are down 39% and prices down 20% in 2022 while our local prices continued to rise into 3rd quarter 2022 making the move north less affordable. In fact, in 3rd quarter 2022, Kerikeri’s median price was the closest to Auckland regions price it has ever been. For people moving from some suburbs in west and south Auckland Kerikeri’s entry level price made moving here impossible without using equity or increasing debt. A correction is now underway.

The closing of roads and challenges with air travel around the country have made it difficult for buyers to get here. There is no doubt that more Auckland and Wellington buyers would have taken action had they been able to come up and inspect their prospective new homes. Residential investors are sitting on the fence in the current uncertain market having been dealt numerous negative regulatory blows and more challenging financial scenarios. Most seem to be holding onto their investments for now.

How are the number of sales tracking?

Kerikeri and surrounds had 41 unconditional residential, lifestyle home and bare land sales in November, December and January compared with 79 sales in the same period last year. A 48% percent decrease.

Bare land sales are significantly down from 18 over the November, December and January period last year to only 3 this year. At the 2022 rate of sales there are several years of bare land inventory available for sale and 6 years of inventory at the pace of sales of the last 6 months. Uncertainty about building costs, and supply chain issues have made building a less desirable option for many.

It will be interesting to see how the number of new house starts and new building consents is affected by this slowdown over the course of the next year. The good news for our construction sector is that there are commercial projects, retirement village expansions and planned government housing projects for Kerikeri that should help to maintain business activity.

What about bare land sales prices?

The low sales volumes over the last year introduced a lot of statistical variance when making comparisons and reduced the relevance of these figures. There are indications from the few sales that have occurred that prices are softening but have not taking a significant correction as they did in 2008 after the Global Financial Crisis.

How long is it taking to sell?

Days to sell have risen from an average of 30 days for sales in November, December and January 2021/2022 to 61 days in the same period of 2022/2023. This is starting to be towards the high end of the 10 year average of 55 to 60 days for our area and likely to increase further as inventory is building.

How are inventory levels tracking?

Inventory levels are up to 280 unique listings for sale on Trade Me in January. This is a rise from 231 a couple of months prior and up from around 150 a year ago. This level of choice on the market has not been seen since November 2020.

How many new listings are coming to the market?

New listing levels are starting to pick up as vendors who put their plans on hold come to the market and the usual post Xmas rush of activity begins. With new listings outpacing sales inventories continue to increase.

What is the outlook for the Kerikeri market?

Interest rate increases over recent months and LVR restrictions have unnerved buyers. FOOP, or the Fear Of Over Paying has replaced FOMO, Fear of Missing Out. More interest rate rises are expected but most predict levelling off in the next 6 months. First home buyers, who have not traditionally been a high percentage of the market in Kerikeri, are few and far between. Based on reasonable numbers of enquiry levels from “out of town” buyers we are expecting the slow and steady migration to the Far North to continue much as it has over the past 10 years. Basically, a return to more normal times with people taking their time to look around, do their homework and make informed buying decisions. Assuming these trends continue, then we can expect our local market to remain slower than the last few years and for some vendors to reduce their prices and take offers they would not have last year.

The good news is that most are still achieving a significant increase in prices from 3 years ago and most economists agree that buyers have a limited window to buy at current levels before prices start to increase again. This should encourage more action over coming months and start to settle the downward trend in median prices.

We can’t predict the highs and lows of the market but what we know for certain is that the tide will always change again. There is an old saying: “Sell when everyone is buying and buy when everyone is selling”. This is the time to buy as the gap between new home prices and existing home prices continues to widen. Sooner or later we will have another upward correction.

Pop in for a coffee and a catch up with any one of us if you are thinking of buying or selling.